Difference Between an Invoice and a Receipt

There are some terms today that are often used interchangeably. A common example is an invoice and receipt even though they mean entirely different things. While the words themselves might not be new to you, the differences might be.

It also doesn't help much that both are used within the accounting part of a business. As a new entrepreneur, solopreneur, or freelance professional curious about the difference; here is a detailed difference between an invoice and a receipt.

For entrepreneurs and small business owners, keeping detailed records of every transaction is essential. It's impossible to manage your money, take care of your business' taxes, or maintain track of your business' performance without a record of purchases, refunds, or exchanges.

It is equally crucial for your clients to have proof of the transaction for their own financial records, as well as in case they experience problems with their orders. As a business owner, you must choose the record-keeping strategy that works best for your company.

Receipts and invoices are typically used by businesses to record transactions for both themselves and their clients, so you'll probably need to do the same. Despite the fact that these two documents serve comparable purposes, they are very dissimilar from one another.

Understanding the key differences in invoice vs, how these two documents—both invoices—differ from one another, and when to provide consumers with either a receipt or an invoice is crucial for keeping your business operating effectively.

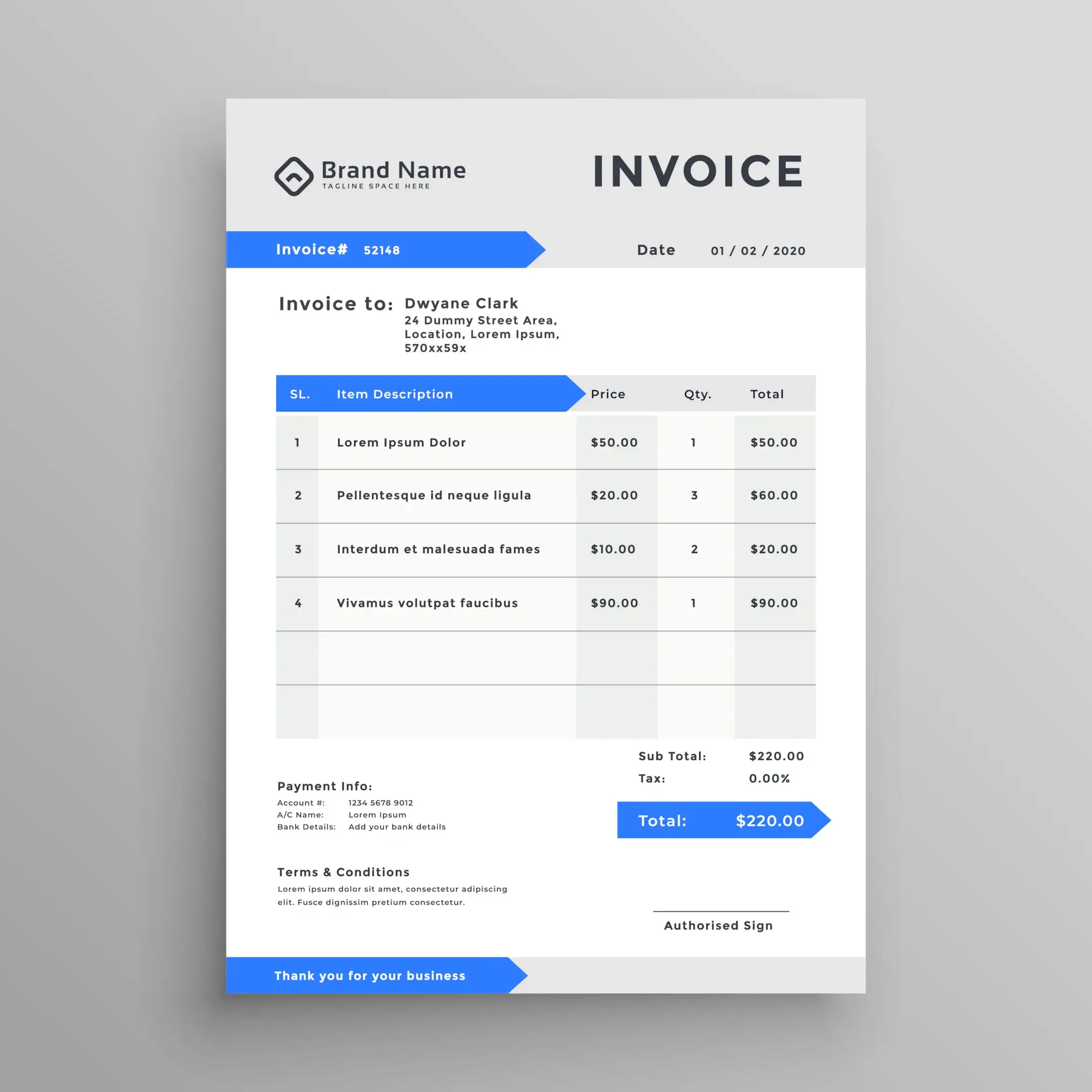

Key Features of an Invoice

An invoice is a legally binding document that outlines a list of items(services or products) purchased and the sum owed by the buyer. This is proof that an order was made and is also a means of requesting payment from a buyer. An invoice is issued by a seller to a buyer listing the following details.

-

Business details (name, address, contact, etc.)

-

Client name

-

Invoice number

-

products /services purchases

-

Taxes if applied

-

The individual cost of items

-

The total amount owed to the seller

-

Dates issued and date of supply

Invoices can be sent electronically in addition to the more conventional methods of printing them out and mailing or faxing them to a client. Since almost all of your business is already done online, electronic invoices, also known as e-invoices, are unquestionably the ideal choice for e-commerce companies.

For both traditional and e-commerce enterprises, an efficient online invoice management system can streamline the collecting payment process, ensuring invoices reflect the correct invoice date and facilitate when a client pays.

Your invoices, whether they are printed on paper or sent electronically, must be carefully read in order to guarantee that you are compensated for your services in a timely and accurate manner.

Key Features of a Receipt

A receipt is a document confirming a client has made payment for a product or service purchased. This is issued after a client has made payment and it contains the following.

-

Business details

-

Transaction date

-

Items purchased and prices

-

Transaction total

-

Taxes

-

Method of payment

A receipt is evidence of payment, whereas an invoice is a request for customers may receive receipt invoices and invoices either physically or online, often through a detailed sales receipt. They are often printed or handwritten immediately at brick and mortar stores, while some also provide electronic receipts received through email.

Even though some e-commerce shops may opt to physically mail it when sending the things out for delivery, many of them give email receipts to customers right away after they make a purchase. Since nearly 70% of Americans prefer paper receipts, even businesses that just do online transactions should think about including them in product deliveries.

Receipts, whether electronic or paper, serve as crucial proof-of-purchase document for both customers and businesses, validating completed transactions and facilitating tax purposes when sales tax is involved.

Customers need receipts as payment proof in the event they encounter issues with a product or wish to return it, and businesses must verify these claims accurately to maintain healthy cash flow and collecting payment accurately.

Tracking sales transactions and managing customer orders can be challenging, particularly when issues arise post-purchase; employing a robust order management system enhances accounts receivable management, ensuring business budgets are adhered to during tax season.

The difference Between Receipts and Invoices

While there are things common with an invoice and a receipt, they both serve and fulfill different purposes. For instance, an invoice is issued before payment is made and a receipt just after payment. The primary purpose of an invoice is to provide a client with details about services purchased or products and to inform them of the payment terms under which the customer pays.

A receipt, on the other hand, serves as one of the payment receipts, confirming that payment has been made using the stipulated payment method. This is vital information for keeping track of company earnings as well as for client records. Because receipts and invoices are issued at different stages of the sales process, they serve different functions.

Invoices, detailing goods or services sold, are issued before the customer sends payment via methods like bank transfer or online payments, whereas receipts, confirming services rendered, are issued post-payment.

The invoice serves as a formal payment request, with specified payment options, and the receipt serves as binding invoice proof of the payment date and total price paid.

This also means that each document, both an invoice and a receipt, requires unique information, clearly delineating invoice vs receipt responsibilities.

The invoice should include a detailed breakdown of the products and services, whereas the payment receipt should only show the amount paid and any outstanding balance. Both documents should be labeled "Invoice" or "Receipt."

How to write invoice and receipt?

Now that you know the difference between an invoice and a receipt, how do you write one? There are several ways you can craft a decent invoice and company receipt for consistent usage. The first step in accomplishing any of these is by understanding the information each document requires.

The second step is by creating a professional template and sticking to it. Depending on whether you offer a receipt on paper, you might have to print out a template to fill. Although, creating a professional invoice might cost you a few bucks.

Alternatively, you can create a professional invoice if you offer invoices and receipts via email. In a few seconds, you can create a professional invoice without any guide. If you would like to create your invoice and receipt from scratch, here is the information you need to include.

What information must be in an invoice

-

Company details which include business name, address, phone number, and or email

-

Invoice number for validation

-

Client name

-

Itemized list of product/services offered alongside individual prices

-

Date issued and date due

-

The completed payment amount owed including Taxes if any

What information must be in a receipt

-

Company details

-

Date issued

-

Client name

-

Items purchased and individual prices

-

Taxes

-

Total amount

-

Payment Type

How to issue a receipt and invoice?

There are quite a several ways to issue a receipt or invoice. An invoice or receipt can be typed, handwritten, issued on paper, or sent electronically. However, ultimately they revolve around paper and electronic methods.

Electronically

While brick and mortar businesses are not seeing a decline in sales, indicating a healthy cash flow, e-commerce is still thriving, often requiring the integration of online payments and invoicing software to streamline the sales process.

This trend shows that more businesses and individuals are relying on electronic invoices, which are essential for maintaining accurate accounts receivable and business budgets during tax season.

With invoice generator, you can send both receipts and invoices straight into clients’ email, marking the invoice date and ensuring payment proof is accessible and that the payment date is clearly recorded.

Paper

The oldest and still trending way to issue a separate receipt and invoice for brick and mortar businesses and shoppers who prefer walk-ins is through customized sales receipts, which help record sales transactions efficiently.

You can opt to create invoices or purchase an invoice book—tools that not only facilitate the sales process but also ensure each completed transaction is documented for accounting and tax purposes.

The Critical Role of Invoices and Receipts in Business Operations

Invoices and receipts are indispensable tools for maintaining meticulous and accurate business records. These documents are essential as they help businesses track their expenses systematically throughout the year. By keeping an organized tally of these financial interactions, a business can maintain a clear and up-to-date overview of its financial health.

Effective management of invoices and receipts is particularly crucial during tax season. If a business faces an audit, having a comprehensive and accessible collection of all payment proofs can simplify the process significantly. This organized data allows businesses to quickly comply with audit requirements, minimizing disruptions and enabling them to focus on core activities.

Moreover, a detailed historical record of business transactions, evidenced through receipts and invoices, is invaluable for financial planning. Business owners can analyze past expenditures to forecast future financial needs, identify potential cost-saving opportunities, and negotiate better terms with service providers.

Additionally, for small business owners, organized records of receipts and invoices facilitate the process of claiming deductions during tax filings. Knowing precisely which amounts to claim each tax season can lead to substantial financial savings.

For businesses looking to modernize their approach to financial documentation, adopting electronic organization methods for receipts can enhance efficiency.

An electronic system not only helps in maintaining an orderly record but also ensures that all financial data is readily available for tax preparation and audit processes, thereby easing the burden during critical financial periods.

Pay Stubs Now: Leaders in financial documentations

There are several documents business owners have to worry about regularly. One of such documents is a pay stub. In most states, providing one is mandatory and can cost quite the sum to make. Typically, businesses have to partner with payroll companies to issue this regularly.

However, as a new business looking to save cost, PaystubsNow, leveraging advanced invoicing software, leads in providing a pro forma invoice service at highly competitive pricing, ensuring that business's finances are well managed through each sales transaction.

In addition to pay stubs, the company also offers 1099 MISC form, and a comprehensive suite of other financial documents to cater to diverse accounting purposes, including credit invoices, debit invoices, and pro forma invoices.