How to choose a paystub generator

When it comes to processing payroll, choosing the right paystub generator will save a company both time and money. For companies wondering whether they should use a paystub generator and how to make that decision, we’ve broken down the decision-making process into these categories:

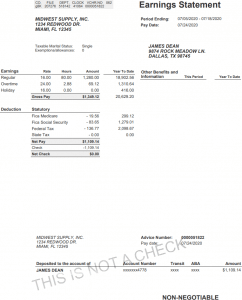

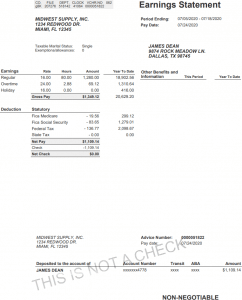

Paystubs are essential to legitimate businesses. Paystubs serve as proof of income while helping people track salary, taxes paid, compensation for working overtime, and more.A company uses a paystub generator to send out those paystubs to its employees. This can be done on paper, or it can be completed online through an email. If a company uses a virtual pay stub generator, it gives employees the option to log in view any current or past paystubs.However, many small businesses choose not to partner with a payroll processing company… usually because such companies tend to charge excessive amounts for their services. This creates a lot of extra administrative work for the business, as they then have to process payroll manually.Unfortunately, though, manual payroll management comes with its own pitfalls. That’s why we strongly recommend that companies use our paystub generator. When companies use our services, they benefit from:

Paystubs are essential to legitimate businesses. Paystubs serve as proof of income while helping people track salary, taxes paid, compensation for working overtime, and more.A company uses a paystub generator to send out those paystubs to its employees. This can be done on paper, or it can be completed online through an email. If a company uses a virtual pay stub generator, it gives employees the option to log in view any current or past paystubs.However, many small businesses choose not to partner with a payroll processing company… usually because such companies tend to charge excessive amounts for their services. This creates a lot of extra administrative work for the business, as they then have to process payroll manually.Unfortunately, though, manual payroll management comes with its own pitfalls. That’s why we strongly recommend that companies use our paystub generator. When companies use our services, they benefit from:

Your work will be made easy by the calculation program designed to count employee payouts. The automatic calculating software completes everything in a matter of minutes and displays the outstanding balance in the event that your employee works overtime or if there is a requirement for any other type of tax deduction. You will receive an accurate result because there is no person involved in this calculation, eliminating the possibility of human error forever. With this software, filing taxes is quite simple. All you need to do to get started is to give the requested information; this clever tool will handle the rest for you.

Your work will be made easy by the calculation program designed to count employee payouts. The automatic calculating software completes everything in a matter of minutes and displays the outstanding balance in the event that your employee works overtime or if there is a requirement for any other type of tax deduction. You will receive an accurate result because there is no person involved in this calculation, eliminating the possibility of human error forever. With this software, filing taxes is quite simple. All you need to do to get started is to give the requested information; this clever tool will handle the rest for you.

- Understanding paystubs and paystub generators,

- Why paystub generators matter,

- The process of choosing a paystub generator, and

- What a company needs to do once they’ve picked the right generator.

Understanding Paystubs and Paystub Generators

Paystubs are essential to legitimate businesses. Paystubs serve as proof of income while helping people track salary, taxes paid, compensation for working overtime, and more.A company uses a paystub generator to send out those paystubs to its employees. This can be done on paper, or it can be completed online through an email. If a company uses a virtual pay stub generator, it gives employees the option to log in view any current or past paystubs.However, many small businesses choose not to partner with a payroll processing company… usually because such companies tend to charge excessive amounts for their services. This creates a lot of extra administrative work for the business, as they then have to process payroll manually.Unfortunately, though, manual payroll management comes with its own pitfalls. That’s why we strongly recommend that companies use our paystub generator. When companies use our services, they benefit from:

Paystubs are essential to legitimate businesses. Paystubs serve as proof of income while helping people track salary, taxes paid, compensation for working overtime, and more.A company uses a paystub generator to send out those paystubs to its employees. This can be done on paper, or it can be completed online through an email. If a company uses a virtual pay stub generator, it gives employees the option to log in view any current or past paystubs.However, many small businesses choose not to partner with a payroll processing company… usually because such companies tend to charge excessive amounts for their services. This creates a lot of extra administrative work for the business, as they then have to process payroll manually.Unfortunately, though, manual payroll management comes with its own pitfalls. That’s why we strongly recommend that companies use our paystub generator. When companies use our services, they benefit from:

- Fewer payroll and paystub errors,

- A significant amount of saved time processing payroll,

- Greater accessibility when it comes to employee payment records,

- And much more.

Why Paystub Generators Matter

To process payroll and provide paystubs manually, businesses need to research and adhere to state laws, keep the employer ID number handy, manually calculate employee hours, and manage any deductions or withholdings. Company provision of paystubs to employees is crucial, as it allows them to track important financial information and helps maintain up-to-date payroll records.The process of manually generating paystubs is time-consuming, and that increases with every person employed. Since providing paystubs will be a regularly recurring process, it could cost the company greatly.That’s why every business needs to implement a system that can generate paystubs quickly. When a business owner picks the right paystub generator, it frees up time to actually run the business instead of getting tied up with administrative work.The Process of Choosing a Paystub Generator

When it comes down to picking a paystub generator, there are several important aspects to take into consideration. Determining which paystub generator to go with should not happen until each of these three variables are considered: the company’s budget, the size of the company, and the features of the paystub generator.1. The Company’s Budget

Before making any decisions, it’s important to establish the business’s budget for a paystub generator. If the budget is nonexistent, luckily, there are some free versions available. Free versions allow easy input of company data and produce a functional paystub.If the budget allows for a small investment in the paystub generator, there are paid websites that provide quality paystubs with additional features for a small fee. The cost is typically only a few dollars each month.2. The Size of the Company

The importance of this aspect in regards to the paystub generator decision cannot be overstated. For example, if a company is paying five employees or fewer who work consistent hours, a free version may provide all necessary features without requiring any monetary investment.However, for small companies paying a larger staff of around 20 workers, likely, a more thorough, dynamic, paid-for system will better meet the company’s needs. In this scenario, the small investment made into a paid version would quickly be earned back when the time spent manually generating paystubs can be cut down to a fraction of the time with a paid paystub generator. As soon as that time is reinvested elsewhere, the investment in the paystub generator essentially pays for itself.3. The Features of the Paystub Generator

People pay different amounts for paystub generators depending on the number of features included and the quality of the paystubs generated. When it comes to the quality, the overall cost of a generator takes into account the number of features, ease of use, and how necessary those features are.It’s worth noting here that the primary differentiating feature between free and paid paystub generators comes down to who is responsible for completing the calculations. Naturally, a free paystub generator requires the company using it to complete its own calculations and then plug in the numbers in the template or corresponding areas. The paid version, on the other hand, completes all calculations on behalf of the company.Other features of a paid paystub generator include:- Access to a variety of templates and styles,

- The type of paper it’s printed on,

- Which pieces of information should be shown (such as payment details),

- Any parts that should remain hidden (such as the employee’s address),

- Black and white or color printing, and

- The amount of historical compensation data included (such as total taxes paid).

What to Do Once You’ve Picked the Right Generator

Once a company has saved their HR department a massive headache by landing on a decision regarding paystub generation, there are a few important steps to consider.1. Be sure to review all paystubs

Before finalizing, saving, and printing any paystubs, it is absolutely essential that every bit of the information on the paystub is accurate. Paystubs serve as a legal record for both the company and the employee when it comes to their earnings record. All of the information… including any errors… will impact salary, income earnings, and taxes.Make absolutely share that all of the seemingly insignificant information is correct. That means double-checking the spelling of the employee’s name, confirming that the pay period is described correctly, and above all, making sure that the earnings and tax withdrawals or withholdings are all 100% accurate. Dollar amounts must be exact, including any cents. They must not be estimated or rounded.Also, confirm that the pay stub template in use is in good standing with any tax laws or local ordinances regarding paystubs. This means that companies may need to make alterations to templates to be sure they are up to code.2. Do not use fake paystubs or an illegitimate paystub generator

Many people aren’t even aware that a paystub can be faked, but the sad reality is that it happens all the time. Some people try to cheat the system by using a false paystub to claim a welfare benefit. This is, of course, illegal, but it still happens.If an employer uses a paystub template to make a fake pay stub, print, and deliver it, that company enables the shady people who are trying to cheat the system. To operate at the highest level of ethical standards, companies need to make sure that their paystub templates are only ever used to produce actual, verifiable paystubs for their employees.3. Make sure that all paystub templates are ultimately disposed of

When a company is finalizing a decision regarding which paystub generator to go with, it’s normal for them to print out some paystub templates as examples. This can help companies clarify whether or not they like the format and arrangement of the information.Once the final decision is made, a company usually feels ready to prepare and distribute paystubs to its corresponding employees. Before handing out any paystubs, though, it’s imperative that the company discards any samples or printed paystub templates to prevent their use in fraudulent activity (as described above). To be as responsible as possible, we recommend that companies shred any leftover paystub templates to prevent them from being stolen and used for fraud.4. Avoid using the paystub generator for intentional errors

Different paystub generator templates are designed for use with different types of employees in mind. For example, the template for a full-time employee with benefits naturally looks different than one for an independent contractor working with the company. If a company uses the incorrect template for an employee’s or contractor’s pay stub, it isn’t just inaccurate. It’s also illegal. For the most part, this fraudulent activity is strictly prohibited because it involves inaccurate information regarding tax withholdings.Benefits of Choosing a Paystub Generator

Perfect Tracker

You can check your inbox or your employees' inboxes to see how many pay stubs you have sent to their email addresses. When needed, you can quickly choose a pay stub generator. Additionally, information about the workers and the business is kept private and confidential. Since they provide their services online, time is not a constraint. Additionally, there is a live chat support option available around-the-clock to help you out, particularly if you run into a technical problem.Automatic calculation means there are no mistakes

Your work will be made easy by the calculation program designed to count employee payouts. The automatic calculating software completes everything in a matter of minutes and displays the outstanding balance in the event that your employee works overtime or if there is a requirement for any other type of tax deduction. You will receive an accurate result because there is no person involved in this calculation, eliminating the possibility of human error forever. With this software, filing taxes is quite simple. All you need to do to get started is to give the requested information; this clever tool will handle the rest for you.

Your work will be made easy by the calculation program designed to count employee payouts. The automatic calculating software completes everything in a matter of minutes and displays the outstanding balance in the event that your employee works overtime or if there is a requirement for any other type of tax deduction. You will receive an accurate result because there is no person involved in this calculation, eliminating the possibility of human error forever. With this software, filing taxes is quite simple. All you need to do to get started is to give the requested information; this clever tool will handle the rest for you.

The pace is great

With the use of this program, you may build a template that you can use for all future pay stubs, saving you both time and effort. As payday draws near, automatic computation will reduce your tension. Simply fill out the template with the necessary information and distribute it to your staff. To cut the workload in half, you might ask your administrative personnel to use this software. Your administrative personnel only need a device and an internet connection to complete tasks at any time, even while seated at home.Simple for your staff

Since this program is accurate, the employees always receive their pay stubs on schedule. In addition to ensuring that the employee doesn't have to go to the bank to deposit the cheque, the pay stubs are generated automatically. Therefore, there is no risk that the check will disappear. Online transactions and processing, as we all know, don't take much time because they don't depend on the regular hours that the bank is open, therefore this system is really prompt. If you have any questions, you can send them or look up all the pertinent information on the portal; this approach makes the process incredibly streamlined and reliable.Environment-friendly

This process is really beneficial for the environment because less paper is used, which lowers the carbon footprint. This approach dramatically lowers paper waste, which is a good start in the right direction for protecting the environment. Choose pay stub generators in place of traditional paper checks to reduce your impact on the environment. Less carbon dioxide will result in a less hazardous atmosphere.More modern and professional

What necessity is there to continue paying employees the traditional way when there are better payment options available in today's gradually digital world? This process appears contemporary and is undoubtedly more expert. People are relying increasingly on plastic money, or cashless transactions, therefore by choosing this approach, you can demonstrate how current and up to date your business is as well as how technologically sound it is. This helps to improve your company's reputation. As more and more online payment applications become available throughout time, switch to more intelligent methods by being aware of the growing requirement of the moment. The fact that your company's name and emblem are still displayed here is worth mentioning.Conclusion on How to Choose a Paystub Generator

Now you know how important payroll is to the ethical operations of a company. And most importantly, you know how to pick which generator will best serve your company’s needs.Today, we covered:- The definition and purpose of paystubs and paystub generators,

- Reasons why paystub generators are so important to companies,

- The process of choosing the right paystub generator, and

- Steps a company needs to take after they’ve picked the right generator.