How to read a check stub?

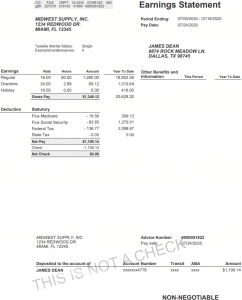

A paycheck stub is a receipt that shows how many hours an employee worked and how much they got paid, detailing their gross pay, net income, and other important details. Here’s a pay stub example.

If an employee receives a physical check, the paycheck stub is attached to the rest of the check via a perforation—just like a ticket stub, showing details such as gross wages, net earnings, and pre-tax deductions. These days, employees aren't always paid by physical check.Make paycheck stubs available for your workers to look at, even if they get their check directly deposited into their bank account, so they can review their gross earnings and taxes withheld.

The check stub serves as their official record, so there's no misunderstanding.Many employees like to keep a physical copy of their check stubs in case they ever need to review their pay or deductions.It’s their confirmation that they were paid correctly.

By quickly looking at his paycheck stub, an employee can immediately see how much amount of money is being deducted each week for common deductions like health insurance premiums, state income taxes, and federal taxes. This way, he can ensure that not too much is being taken out. A recent poll found that 25% of workers reported receiving a paycheck with mistakes in their gross earnings, net income, or tax deductions.

A decent check stub and paystub template makes it possible for you to maintain an accurate and transparent payment record, showing total earnings, net earnings, and federal income taxes, ensuring accuracy for your employees.

It’s also proof of income if he wants to apply for a loan or other form of credit, detailing his net income, gross earnings, and other deductions. He might need this proof if he quits your company and gets a job elsewhere. That’s because requesting verification of pay is one way employers check to ensure what an employee says he got paid is what he actually got paid.

Are Check Stubs Required by Law?

There's no federal law that mandates companies have to provide their workers with a check stub. However, many states have laws that require some form of written pay statement. Here are the states that require written or printed check stubs to be given to all employees:

California

Colorado

Connecticut

Iowa

Maine

Massachusetts

New Mexico

North Carolina

Texas

Vermont

Washington

Here are the states that don’t have this requirement:

Alabama

Arkansas

Florida

Georgia

Louisiana

Mississippi

Ohio

South Dakota

Tennessee

These are the states that mandate that employees at least have some way of accessing information printed on a check stub:

Alaska

Arizona

Idaho

Illinois

Indiana

Kansas

Kentucky

Maryland

Michigan

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New York

North Dakota

Oklahoma

Pennsylvania

Rhode Island

South Carolina

Utah

Virginia

West Virginia

Wisconsin

Wyoming

Even if you happen to dwell in a state that doesn't require pay stubs, you're still legally bound by the Fair Labor Standards Act to keep track of the hours your employees work.

How Do You Read a Check Stub?

Here are the various elements to a standard paycheck stub, including gross pay, net income, and tax deductions:

EMPLOYEE NAME AND ADDRESS: The full name of the individual getting paid.

COMPANY NAME AND ADDRESS: This is your company's name and address. You can add its phone number here if you want.

IDENTIFYING INFO: Some businesses include an employee ID or Social Security number on the check stub to provide additional identification of the employee.

PAY TYPE: This indicates if the worker was paid by the hour or is a full-time employee, impacting their gross wages and net earnings.

PAY DATE: The date on which an employee receives a check is the pay date, reflecting the current pay period and total gross pay. Companies often pay their employees on a regular schedule, such as every Friday.

PAY PERIOD: The pay period is the timeframe an employee gets paid for, showing the dollar amount of their gross earnings and net income for that specific period. For example, a biweekly pay schedule means the worker gets paid every two weeks.

HOURS WORKED: The hours worked is the time the employee spends doing his job. This varies for hourly employees. For salaried employees, a paycheck will usually cover all work completed within a 40-hour workweek.

PAY RATE: The pay rate is what an employee makes per hour. For example, an hourly worker might earn $15 an hour for a 35-hour workweek. This means $15 is the pay rate.

EARNINGS: Another word for earnings is gross wages. This is the full amount of money owed to an employee before expenses like taxes and deductions are taken out. Usually, workers can see not only the wages earned in the pay period covered by the check but also year-to-date information.

WITHHOLDINGS: These are withholding taxes for things like federal income tax, state income tax, and Medicare taxes, which the federal government requires.

These taxes will later show up on an employee's W-2 for tax filing purposes during tax season, helping to determine how much tax they owe.

DEDUCTIONS: Pre-tax deductions are items a worker can choose to get deducted from his pay, such as contributions to a health savings account, flexible spending accounts, and other employee benefits. An employee can choose to deduct contributions for a 401(k) or pensions, health savings accounts, or other employee benefits, reducing their federal income and state income taxes. Deductions held pre-tax (from gross income) have the advantage of not being included in tax calculations.

NET PAY: Net pay is what a worker gets to take home after federal income taxes, state taxes, and other withholdings are deducted, showing their net income for the current pay period.

EMPLOYER TAXES: The employer pays some taxes that the employee doesn't have to, such as the Federal Unemployment Tax Act, which contributes to the employer's tax burden. As a result, some businesses include an employer tax section on their pay stub.

EMPLOYER CONTRIBUTIONS: Employer contributions show how much the employer contributes towards benefits like retirement and healthcare, which are reflected in the employee's pay details, impacting the overall employee benefits package.

ACCRUED VACATION TIME: Some companies have a section that includes an employee’s accrued vacation, sick days, or paid time off.

FICA in a Check Stub

FICA is a payroll tax paid by both employees and employers to fund Social Security and Medicare. These are federal programs providing benefits for retirees, people with disabilities, and children of deceased workers.

The FICA law requires employers to withhold 6.2% Social Security tax, 1.45% Medicare tax, and 0.9% Medicare surtax when an employee earns more than $200,000.

What is the significance of pay stubs?

Check stubs are an important aspect of payroll processing since they act as a receipt of payment for businesses. They ensure that taxes and employee deductions for health benefits and retirement plan payments were withdrawn as necessary for a particular pay period.

Paycheck stubs are less important to employers, but they are significantly more important to employees since they display a breakdown of their pay, including gross earnings, net income, and taxes withheld.

They also serve as proof of payment, which is necessary if the employee wishes to obtain a loan, showing detailed gross pay and net earnings. Most lenders want one or two months of check stubs when an employee applies for a mortgage.

Hourly vs. Salary

Hourly employees are paid by the hour. They're legally entitled to receive overtime pay if they work over 40 hours in a single week. Salaried employees aren't given overtime pay, but company-provided benefits are often more generous than those provided to hourly workers.All hourly workers are considered non-exempt employees under the Fair Labor Standards guidelines.

Non-exempt employees aren't exempt from being paid overtime. They must be paid time and a half for all hours worked over 40 in any given week. For instance, if a worker puts in 65 hours in a single week, his compensation would be 40 x $15 for his regular 40 hours plus 15 x $22.5 for the 15 overtime hours. Hourly employees are often not guaranteed a set number of hours of work per week unless covered by a labor contract.

An hourly employee’s hours per week may vary based on his or her weekly schedule. Sometimes, employees have a shift schedule that changes every week. This means their hours might change from week to week.

These employees must be paid, at the least, minimum wage.The minimum wage varies from state to state, and some counties and cities also have a range of rates. Companies must pay their hourly employees either the state or federal minimum wage, whichever is greater.

Net Pay of a Check Stub

The total amount a worker receives after all deductions are taken out is known as "net pay," which includes tax deductions and taxes withheld. For hourly employees, the check stub should list the hours worked and the hourly pay rate.

For salaried employees, this amount is usually 35 to 40 hours a week, detailing employee's pay before and after withholding tax. The pay stub should also include overtime if the worker is eligible and the rate and hours of any overtime worked.

How to Choose the Best Check Stub Generator

For various legal and practical reasons, you need to provide check stubs to every single employee who works in your company.If you run a company and don't partner with a payroll processing service, you must go through the tedious rigmarole of manually processing your

Analyze the Needs of Your Company

Do your research before selecting the finest pay stub maker for your organization. That implies you must assess your company's requirements in terms of which features would be most beneficial. For example, if you own a small firm with less than 100 workers and no in-house HR staff, your requirements may differ from those of a larger corporation.

It's also critical to consider your employees' requirements. For example, you may have a few employees that must be paid weekly and only accept direct deposit. Other employees, on the other hand, may desire paper check stubs for their records or to present to others as evidence of income. One factor to consider is the cost of each service.

You should carefully examine the rates of various services to ensure that you are getting the most value for your money, without increasing your employer's tax burden. Make certain that you are not overpaying for anything that may not even match your demands completely or may not operate as stated.

Many individuals have had a foul taste in their mouths after spending money on things that did not live up to their expectations. Unfortunately, this happens much too frequently and may be prevented with enough forethought.

Do you need to create your own pay stubs?

It's simple to produce pay stubs for your employees by following the steps outlined above, albeit it can be laborious and time-consuming. There are several check stub generators and templates accessible online if you wish to create your own pay stubs. Templates for Excel and Word are available, and they differ by state and employee type.

How To Make Pay Stubs

At PayStubsNow.com, you'll get accurate and dependable documents delivered right to your email quickly and easily. It’s the best way to get pay stubs online. In just a couple of super easy steps, you can create your own check stubs that are immediately sent to your email.Our service is perfect for both employers and employees.Check us out today!