Small Business Grants: Grants & Programs & How to Apply

Embarking on a new business venture or trying to boost a small business often requires more than just a spark of innovation; it needs funding. That said, securing the right financial resources can make all the difference. This is where small business grants come in, allowing business owners to access vital funds at no cost.

This blog will examine the world of small business grants, from understanding what they are to learning about the diverse range of grants available. We'll explore federally funded start-up options, including specific programs like SBIR and STTR and offerings from the Small Business Administration.

We'll also help you find these grants, apply, and leverage tools like Paystubsnow to help maintain essential documents.

Main Takeaways From This Article:

- Federal programs like SBIR, STTR, and RBDG offer specific support for start-ups and rural businesses.

- SBA grants provide tailored programs to aid micro-entrepreneurs and support trade expansion projects.

- Leverage trusted online resources, networking, social media, and newsletters to discover grant opportunities.

- Gather required documentation, write compelling applications, and meet deadlines to apply for grants successfully.

What Are Small Business Grants?

Small business grants are non-repayable funding sources provided by government agencies, private organizations, or nonprofit entities to support the growth and development of small companies. Unlike loans, they don’t accumulate interest or require repayment.

Types of Small Business Grants

Small business grants can be classified into:

- Government-Funded Grants: These are provided at multiple levels, including federal, state, and local governments. Each level of government grants has specific criteria and objectives aimed at supporting businesses and spurring economic growth in their jurisdictions.

- Private or Corporate-Funded Grants: Many private entities and corporations offer grants to small businesses to support innovation, entrepreneurship, and business development. These grants can be specific to industries aligned with the corporation’s interests or broader community-focused initiatives.

Federal Grants for Small Business Start-Ups

Now that we know what small business grants are, let's explore some federal grants to support your small business and start-ups.

Small Business Innovation Research (SBIR) Program

This grant encourages small businesses to engage in federal research and development with the potential for commercialization. By linking entrepreneurial companies with federal agencies, SBIR investments stimulate technological innovations that may address societal needs.

Early-stage start-ups receive critical early funding to develop new products or services with strong market potential. The program operates in three phases: supporting concept feasibility, prototyping development, and facilitating the transition of innovations into the marketplace.

Small Business Technology Transfer (STTR) Program

This program builds collaborative partnerships between small businesses and nonprofit research educational institutions. This approach ensures that scientific discoveries made in academic settings can effectively translate into commercially viable innovations.

STTR supports high-risk, high-reward projects that span multiple technical areas, allowing start-up companies to leverage external expertise and resources. Eligible applicants follow a three-phase structure similar to SBIR, starting from conceptualization to prototype development and leading to a functioning product or service.

Rural Business Development Grants (RBDG)

This grant aims to support small businesses and new entrepreneurs operating in rural areas by expanding economic opportunities, creating jobs, and improving quality of life. Administered by the U.S. Department of Agriculture (USDA), these competitive grants provide funds for training, technical assistance, and business planning activities.

RBDG may also invest in physical infrastructure, equipment purchases, and building improvements crucial for growth. By stimulating innovation and resilience, these grants encourage business development and strengthen the fabric of rural communities.

Economic Development Administration (EDA) Grants

This grant is designed to boost regional economies, spur innovation, and create employment opportunities. EDA’s programs encourage collaborations to enhance competitiveness, tackle economic distress, and support entrepreneurship.

Funds can be used for various projects, including infrastructure development, workforce training, planning studies, and research. Small business startups, nonprofits, and local governments can benefit from this program by expanding their capacities, entering new markets, or leveraging technology.

Small Business Administration (SBA) Grants

Let's move on to SBA grants. Below, we explore some key programs that can aid your business journey.

Program for Investment in Micro-Entrepreneurs (PRIME)

This grant aims to strengthen the capacity of microenterprise development organizations that provide training and technical assistance to low-income and disadvantaged entrepreneurs. Offering grants to nonprofit organizations helps them deliver essential business services, including financial management, marketing strategies, and operational improvements.

PRIME focuses on underserved local communities, ensuring small businesses can easily overcome common barriers, access capital, and establish sustainable growth.

SBA State Trade Expansion Program (STEP)

This assists small businesses in expanding their reach into international markets. Through grants to state-level trade agencies, STEP helps firms learn export regulations, attend foreign trade shows, develop marketing strategies, and cover translation or website localization costs. This support encourages them to tap into global consumer bases, diversify their revenue streams, and compete effectively abroad.

By enhancing export readiness, STEP promotes U.S. small business competitiveness, leading to job creation, economic growth, and a stronger presence.

7(j) Management and Technical Assistance Program

This program provides specialized training, consulting, and mentoring to small businesses operating in economically disadvantaged areas. Funded through grants and contracts, it equips firms owned by socially and economically disadvantaged individuals with critical management, marketing, and operational skills.

Participants receive tailored guidance on business planning, financial success management, contract bidding, and compliance with federal regulations. The 7(j) Program enhances their competitiveness, increases contract opportunities, and builds economic vitality.

SCORE Mentorship Program

This grant connects aspiring and existing entrepreneurs with volunteer business mentors who offer free, confidential guidance. Supported by the SBA, SCORE pairs clients with experienced professionals drawn from diverse industries.

Participants can access practical advice on business planning, market research, financial forecasting, and growth through one-on-one sessions, workshops, and webinars. Mentors also help navigate challenges, identify new opportunities, and refine skills over time.

By nurturing entrepreneurship, this program supports the success and longevity of small businesses.

How To Find Small Business Grants

Now that you know all the different types of grants, we will walk you through some effective ways to find these grants to kickstart your funding journey.

Online Resources

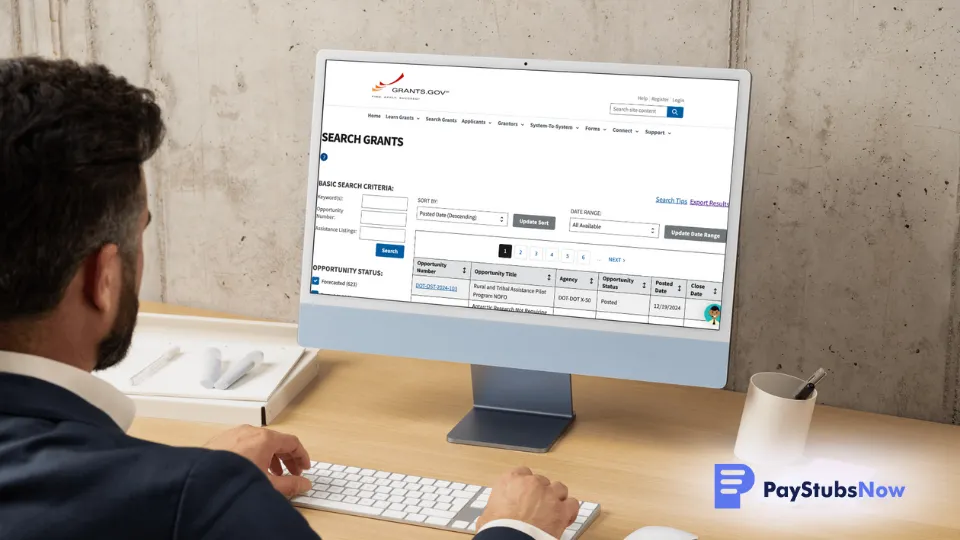

Grants.gov is a comprehensive database that is a one-stop shop for finding and applying for federal grants offered by various government agencies. SBA.gov, the Small Business Administration’s site, offers many resources catering to small business concerns by providing grants, loans, and mentorship programs.

Local Economic Development Agencies, which engage with local agencies, can provide insights into region-specific grants and funding opportunities tailored for businesses in your area.

Networking

By attending industry conferences, joining local entrepreneurial groups, and participating in trade associations, you can connect with potential mentors, investors, and advisors who may have firsthand knowledge of grant opportunities.

Building genuine relationships over time increases your chances of receiving guidance and references. Don’t hesitate to ask trusted contacts if they’ve encountered funding sources directly. A simple conversation can lead you straight to valuable grant leads.

Social Media

LinkedIn can connect you with professionals who frequently share tips on financing. Join specialized Facebook groups or follow industry influencers on Twitter to stay updated with new funding announcements.

Regularly browsing relevant hashtags and participating in online conversations can help you stand out. Consider writing thoughtful comments or sharing helpful articles to gain trust and visibility. Over time, these interactions can reveal valuable grant leads.

Newsletters

Sign up for newsletters from government agencies, nonprofit organizations, and industry associations that compile ongoing funding information. Many newsletters highlight relevant deadlines, application criteria, and success stories, enabling you to prioritize promising leads.

You can also subscribe to professional consultant newsletters or financial media outlets for insight into emerging grants. By carefully reading these updates, you’ll stay ahead and be ready to apply.

How To Apply for Small Business Grants

With all this information at your disposal, let's move on to understanding how to apply for small business grants with our step-by-step guide below.

1. Identify Eligibility Criteria

This sets the stage for gathering all the necessary information and ensuring that your business fits the grant guidelines you're pursuing. Here are key points to consider:

- Business Type: Verify if the grant is limited to particular business types or industries, like technology or agriculture.

- Size and Revenue: Grants may specify eligibility based on the business size or annual revenue. Confirm your figures align with these requirements.

- Purpose of Funding: Grants are often designed for specific purposes such as research, expansion, or community development. Check if your intended use matches the grant’s focus.

- Stage of Business: Some grants cater to start-ups, while others target established businesses. Ensure your business stage fits the grant’s criteria.

2. Gather Documentation

Once you've determined that your business is eligible for a grant, the next step is to gather the necessary documents. Here's a checklist of essential documents to prepare before you apply:

- Business Plan: A detailed outline of your business goals, strategies, and financial projections is very important.

- Financial Records: Keep accurate and up-to-date financial statements, including income statements, balance sheets, and cash flow statements.

- Legal Documents: Include your business licenses, permits, and registrations to prove your business's legal standing.

- Tax Returns: To demonstrate financial health and stability, be sure to have copies of your most recent tax returns.

3. Write a Compelling Application

The key is to articulate a clear, concise story that resonates with the grant providers, presenting your business as a leader worth investing in. Here are some tips to help you create a compelling application:

- Craft a Persuasive Narrative: Tell the story of your business, highlighting your journey, mission, and the impact you aim to make. Make it personal and engaging to connect with the reviewers.

- Emphasize Your Unique Value Proposition: Clearly outline what differentiates your business from competitors. Explain the unique benefits you offer and how your approach solves problems.

- Include Detailed Financial Projections: Provide comprehensive financial statements demonstrating your business's current standing and future growth potential. Be transparent.

- Illustrate Impact and Sustainability: Describe how the funding will be utilized effectively. Discuss the long-term sustainability of your project and its positive impact on your community or industry.

4. Submit on Time

Ensuring timely submission is crucial once you've crafted a compelling application. Here are some effective ways to get your application submitted on time:

- Review Submission Guidelines: Before submitting your application, double-check the guidelines to confirm you've followed all instructions regarding deadlines, format, and submission method.

- Complete in Advance: Aim to complete and review your application well before the deadline. This buffer period allows you to make necessary revisions and reduces last-minute stress.

- Submit Early: Consider submitting your application a few days before the deadline. Early submissions can prevent technical issues or unexpected delays that might arise at the last minute.

- Keep a Record: Maintain a copy of your submitted application and any correspondence. This record can be invaluable if any questions or issues arise during the review process.

5. Follow Up

After submitting your grant application, following up is critical to stay informed about your application's status. Here's how to effectively follow up on your application:

- Confirm Receipt: Reach out to confirm that your application has been received. This shows your attention to detail and ensures there were no issues with your submission.

- Inquire About Timeline: Ask about the timeline for the review process. Knowing when decisions are expected will help you plan any further follow-ups.

- Demonstrate Enthusiasm: If you haven't heard back within the mentioned timeframe, contact them again to inquire about any updates, reinforcing your enthusiasm for the grant program.

- Learn About Next Steps: If your application is under consideration, ask what the next steps are, whether it involves interviews, presentations, or other requirements.

Maintain Essential Financial Documents and Grow Your Business With Paystubsnow

Paystubsnow is a vital ally to refine your financial practices.

Our platform guarantees compliance with various state regulations, ensuring peace of mind for business owners. Opt for Paystubsnow’s turnkey solutions to save valuable hours with ready-to-use options that streamline your workflow. With around-the-clock customer support, you can rely on Paystubsnow's responsiveness to guide you through any challenge.

Plus, customization is key – tailoring services to fit your unique needs, unlike the one-size-fits-all approach many others provide. Equip your business with these resources and enhance your chances of securing grants by maintaining impeccable records.

Experience the benefits today with Paystubsnow and transform how you handle your business documents.