What Is an Underpayment Penalty? IRS Rules & How to Avoid It

Tax laws are often complex and can feel overwhelming, especially for small business owners, independent contractors, and those who are self-employed. The first step is to be aware of the IRS underpayment penalty, which can catch many taxpayers off guard. To avoid unnecessary financial strain, it is important to understand what this penalty entails, who it affects, and how it is calculated.

In this article, we will explore the details of the underpayment penalty, look at who is affected by it, and outline effective strategies for avoiding it. We will also discuss how Paystubsnow’s services can help document and track earnings to ensure proper estimated tax payments.

Main Takeaways From This Article:

- The IRS imposes underpayment penalties on taxpayers who do not pay estimated taxes adequately throughout the year.

- Self-employed individuals, small business owners, freelancers, gig workers, and even W-2 employees may be affected.

- Understanding calculation methods and thresholds can help you gauge the risk of incurring a penalty.

- Effective strategies for avoiding the penalty include making timely estimated tax payments and referring to the IRS guidelines.

What Is an Underpayment Penalty?

An underpayment penalty is a fee imposed by the Internal Revenue Service (IRS) on taxpayers who do not pay enough of their tax liability through withholding or estimated tax payments. This penalty is levied to encourage timely tax payments rather than waiting until tax season when a lump sum is due. Instead of taxing you on your entire income at once, the IRS expects that you'll remit taxes as you earn your income via estimated payments.

Who Is Affected by the Underpayment Penalty?

The underpayment penalty can affect a wide range of taxpayers, particularly those whose income fluctuates or who are not subject to consistent withholding, such as:

- Self-Employed Individuals and Independent Contractors: These individuals typically generate income without the benefit of withholding tax from their earnings. As a result, they must proactively calculate and make sufficient estimated tax payments quarterly.

- Freelancers and Gig Workers: Like self-employed individuals, freelancers and gig workers often juggle multiple income streams. Given the sporadic nature of this income, they may find it difficult to estimate their tax liability accurately, which can lead to underpayment penalties.

- Small Business Owners: Running a small business involves managing various expenses and profits. While self-employment allows for tax deductions, it also means managing quarterly estimated tax payments correctly to avoid penalties.

- W-2 Employees With Insufficient Withholding: Even traditional employees may incur underpayment penalties if they do not have enough tax withheld from their paychecks. This often happens when individuals have additional sources of income that are not subject to withholding.

- High-Income Earners: Earners in the high-income category face unique challenges due to progressive tax rates and the increased complexity of their financial situations. They are particularly exposed to underpayment penalties if they fail to make adequate estimates against their projected tax liability.

How Does the IRS Calculate the Underpayment Penalty?

The IRS calculates the late estimated tax penalty based on the difference between what you should have paid in estimated taxes and what you actually paid.

You can avoid the IRS tax underpayment penalty by meeting one of these thresholds:

- You owe less than $1,000 in taxes after subtracting your withholding and refundable credits.

- You paid at least 90% of the tax you owe for the year.

- You paid 100% of the tax shown on your tax return for the prior year.

If you fall short, the underpayment penalty applies. The calculation involves determining the amount of underpayment for each quarter, applying the applicable penalty rate, and summing the results. The IRS uses the following formula to assess this fee:

Penalty = (Underpaid Amount) × (IRS Underpayment Penalty Rate)

IRS Underpayment Penalty Rate

Here is a table summarizing the IRS quarterly penalty rates for 2025. The table provides a clear overview of the different interest rates that apply for various tax scenarios:

Interest Categories | 1st Quarter (Jan–Mar) |

Non-corporate Overpayment (for example, individual) | 7% |

Corporate Overpayment | 6% |

Underpayment (Corporate and Non-corporate) | 7% |

GATT (Part of a Corporate Overpayment Exceeding $10,000) | 4.5% |

Large Corporate Underpayment (LCU) | 9% |

Internal Revenue Code (IRC) 6603 Deposit (Federal Short-term Rate) | 4% |

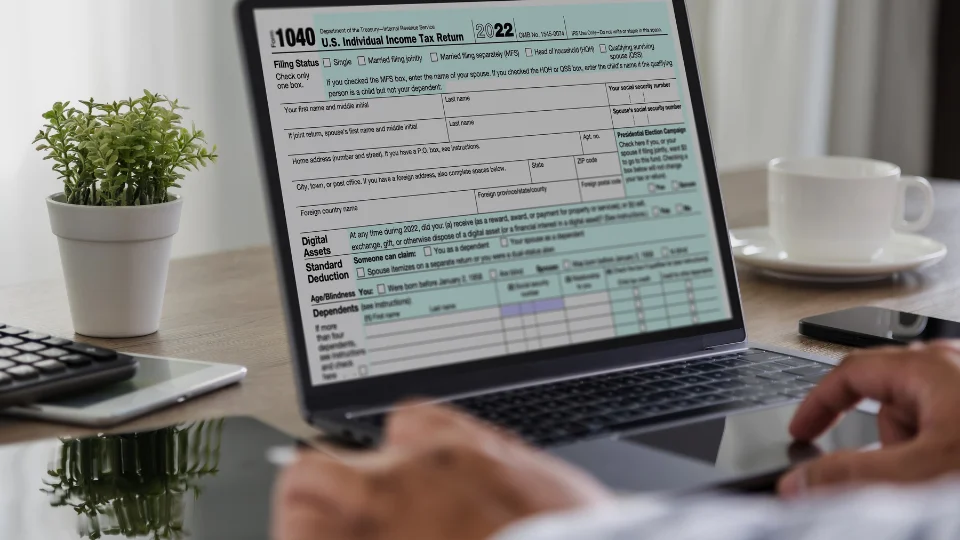

IRS Form 2210

If you believe you have an underpayment penalty, file IRS Form 2210, "Underpayment of Estimated Tax by Individuals, Estates, and Trusts." This form helps determine if a penalty is owed and calculates the amount, and it guides you in providing necessary calculations on your estimated tax payments.

How to Avoid Underpayment of Estimated Tax Liability

Understanding how to avoid underpayment penalties can save you from incurring unnecessary fees and stress. Here are some methods to consider:

Make Quarterly Estimated Tax Payments

The most effective way to avoid underpayment penalties is to make timely quarterly estimated tax payments according to IRS guidelines.

These payments can be calculated based on your projected income and tax situation each quarter and are due on April 15, June 15, September 15, and January 15 of the following year.

Use the Safe Harbor Rule

This rule offers guidelines to avoid penalties. By satisfying one of the conditions—having tax payments that equal 90% of your current year's tax or 100% of your previous year’s tax—you can protect yourself from penalties.

The Safe Harbor rule provides a safety net for you, even if your current year's income is higher.

Increase Income Tax Withholding (W-2 Employees)

If you are a W-2 employee, you can re-evaluate your payroll withholding amounts. When you adjust your withholding, you allow your employer to withhold a larger portion of your wages for taxes, which can help you manage your overall tax liability more effectively.

By opting for a higher withholding rate, you pay taxes throughout the year rather than paying a lump sum when tax season arrives. This approach lowers the risk of underpayment penalty, as enough tax is remitted to the IRS in a timely manner. To make this adjustment, you will need to fill out a new W-4 form indicating your desired withholding status.

Keep Track of Income and Expenses

Accurate income tracking and meticulous record-keeping are crucial components for effectively calculating estimated tax payments. This practice is especially relevant for self-employed individuals and small business owners who may not have automatic withholding to rely on.

Maintaining clear and precise records helps you understand your financial landscape and ensures that you can estimate your tax liability accurately. To simplify this process, use accounting software, spreadsheets, or mobile apps designed for tracking expenses and revenue. These tools can help you categorize income sources and document business-related expenses, which are vital for calculating your net earnings for tax purposes.

Use IRS Payment Plans if Needed

If you have a substantial tax liability that you cannot pay in full by the filing deadline, an IRS payment plan, also known as an installment agreement, can provide a valuable solution.

This agreement allows you to pay your outstanding tax debt in manageable monthly installments. By entering into a payment plan, you can avoid further penalties and interest accrual that would occur if you simply ignored the debt and let the failure to pay penalty occur.

Note: The IRS offers various payment plan options, including online applications and direct debit, to make it easy for you to manage your tax debt responsibly.

Exceptions to the Underpayment Penalty

While the IRS expects taxpayers to pay their taxes as they earn income, certain exceptions to the underpayment penalty are designed to provide relief in specific circumstances, for example:

- If your total tax liability for the year is under $1,000, you will be exempt from the penalty.

- If you had no tax liability in the preceding tax year, you may be excused from underpayment penalties in the current year.

Moreover, the IRS may waive the penalty if the underpayment was due to casualty, disaster, or other unusual circumstances, such as a serious illness. If you retired or became disabled during the tax year, you may also qualify for an exception.

Paystubsnow Helps Track Tax Payments and Avoid Underpayment Penalties

The IRS underpayment penalty can complicate your financial picture if left unaddressed. By understanding how the penalty works, knowing who is affected, and employing strategic measures to avoid it, you can take proactive steps towards sound tax planning.

For self-employed individuals, independent contractors, and small business owners, accurate record-keeping is paramount. Our platform provides templates for generating professional pay stubs, invoices, and tax documents like Form 1099, which can help these individuals track their earnings and expenses. This helps calculate accurate estimated tax payments and reduces the risk of underpayment penalties.

By using Paystubsnow, you can maintain organized financial records and confidently manage your tax obligations throughout the year.